A Day to Remember

We have been keeping our social commentaries restricted to the social section, but last Saturday was so important that we feel responsibility to alert all readers. With passage of time, the event of Saturday will be seen as the biggest financial turning point in a century. Every financial blog we follow realized its significance and posted several commentaries. In fact, most of them stopped discussing anything other the event. We compiled a large list of such commentaries here.

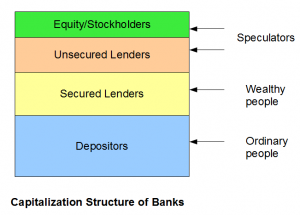

What happened? Cyprus government was forced by European Union and IMF to confiscate bank savings of ordinary people to bail out wealthy bondholders. This is a game-changer violating basic tenet of banking, and is likely to cause panic in all debt-ridden countries with failed banking systems. That includes Greece, Italy, Spain, Portugal, France, UK, USA, Holland and several others. We explained the bank capital structure in an earlier commentary, but it does not hurt to present the figure again.

As we explained in the linked commentary, allocating losses after failure of a bank has long-established legal procedure, and depositors are expected to take losses after everyone else.

In more civilized times, there was a long established precedent regarding the capital structure of a bank. Equity holders incur the first losses as they own the upside profits and capital gains. Next come unsecured creditors who are paid a higher interest rate, followed by secured bondholders who are paid a lower interest rate. Depositors are paid the lowest interest rate of all, but are assured to be made whole, even if it means every other class in the capital structure is utterly wiped out.

Those rules cannot be changed on the fly by legislators of a country, because it is only by making depositors safe, a fractionally reserved banking system can function. In a fractionally reserved banking system, banks loan out most savings of depositors. Only a small part is kept to allow normal withdrawals so that depositors do not understand what is going on or feel unsafe. There are times, bankers take depositors as granted and do things that would make people start figuring out how banks work. That is never a good idea as Henry Ford explained prior to the last global depression.

It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.

We will continue to monitor and discuss the ramifications in our social section, and get back to bioinformatics soon. Apologies for lack of regular commentaries. We are trying to write up our genome paper, and it is quite a bit of time to cross all the i’s and dot all the t’s, or the other way :)