Study on Return of US College Education is Less Alarming than Reality

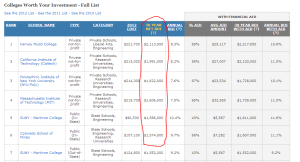

A study by former US Secretary of Education found that US college education, as an investment, pays off for only 150 out of 3,500 US colleges. We took a look at the data used for the study and found that the results are very skewed. If the analysis is done properly, college education would appear to pay off for far fewer number of colleges.

The analysis missed two important factors - debt and demographics. Take a look at the first few rows of their table for example. To estimate future potential income, it assumed that the income over the next 30 years for students graduating today will be comparable to the income between 1982-2012 for those, who graduated in

- However, the students, who graduated in 1982 started with a nearly clean slate and had the positive boomer demographics on the back of their sail. Students graduating today will have to first satisfy the student-debt monsters before they can start accumulating wealth. Why is that bad? It is because many of the high-income people are business-owners and a capital-less business has less chance of surviving. Please read our Economics in One Lesson to understand the importance of capital (‘saved coconuts’ in the story) in capitalism.

For example, the following news article reported -

Student loans: Ben Bernanke’s son medical school debt to reach $400,000

Even Federal Reserve Chairman Ben Bernankes son cant expect to escape the debt burden. The elder Bernanke testified before Congress last year that his son is on track to leave medical school with $400,000 in loans. The figure may include accrued interest and undergraduate costs. His son attends Weill Cornell Medical College in New York, according to the school directory. Bernanke, through a spokeswoman, declined to comment.

Consider two factors.

1. At 8% compounded rate of interest, Ben’s son will have to pay nearly $45,000 every year for 30 years in principal and interests before he can accumulate any savings. The boomers graduating in 1982 had minimal amount of student debt.

2. Unlike his father, who started his career in an economy that saw boom over much of the following 30 years, he will start in an economy that will see mostly deflationary depression after he graduates. Take a look at the following very long term chart of SPX stock index. Mean reversion alone suggests that stock indices will underperform over the coming decades.

The fact that college education is uneconomic for almost all US colleges will have severe ramification for those planning to join PhD programs with the hope of becoming college professors. A small percentage of colleges of today will outlast the coming depression and those surviving will see extensive reorganization from how they are being run today. Do not fall for the STEM scam being promoted by colleges to get sucked into college debt. STEM or otherwise, US colleges are not worth paying for at the current prices.

Also check:

College Grads: It’s a Different Economy

What Will Scientific Publishing Be Like Ten Years from Now?

The Source of High Inflation: Government Spending