What is Causing European Banking Crisis?

If you want the answer in one word - ‘ignorance’.

In Titin episode Prisoners of the Sun, Incas were ready to burn Tintin and Haddock on wooden pyres, when a solar eclipse started. Incas were ignorant about the phenomenon of solar eclipse. So, Tintin convinced them that he was taking the sun God away and he could do many other harms, if Incas did not release him immediately.

The same dynamics is playing out in Europe and USA over the last few years, except that the ordinary Westerners are in position of the Incas.

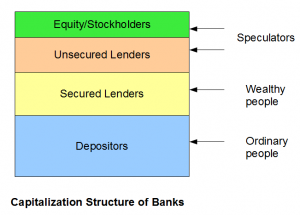

I will keep this commentary short by presenting only the most important information, and let you do your own research to find out the details. Here is a typical capitalization structure of a bank.

When a bank is in trouble, the capitalization structure starts to erode from the top. Legally, only after the top three layers are eaten, the lowest group starts to see any loss. However, the secured bondholders, who often come from the wealthy and powerful, spread false stories about depositors being threatened and get bailout after bailout to keep their positions unharmed. Only on rare occasions, they come out in the open, when the technique of implicit threats fail.

None of this is news for those working in financial industry, but public keeps getting duped again and again due to widespread ignorance about how banks work. Believe it or not, we have been warning anyone, with attention span of more than few minutes on banking matters, since 2005.

John Hussman, a well-known Hedge fund manager and far more articulate than us, explained how banks work in simple language in two articles written in 2008. You may find them useful.

September 29, 2008: You Can’t Rescue the Financial System If You Can’t Read a Balance Sheet

September 22, 2008: An Open Letter to the U.S. Congress Regarding the Current Financial Crisis

Based on our experience, we are not very hopeful that people will pay attention until it is too late. So, expect this picture to be commonplace in many other countries.