UK Plans to Piss Away a Lot of Money on Genomics Misadventure

**Edit. I got millions and billions mixed up here. They are not spending 1/5th GDP as I thought initially (thank God). **

-——————————————

Just before Christmas, the following news hit the wires -

UK’s National Health Service To Study 100,000 Genomes To Help Fight Cancer, Genetic Diseases

The UKs National Health Service (NHS) announced the establishment of 11 Genomic Medicine Centers to achieve an ambitious goal of decoding and collecting the complete genetic codes of 100,000 people by 2017. The aim of the project, named the 100,000 Genomes Project, is to better diagnose and treat patients with cancer and rare genetic diseases, the NHS said in a statement released Monday.

The project will attempt to sequence the complete DNA, also known as the genome, of people with cancer and rare diseases, and then compare it to the genome of their family members. This method will allow doctors to spot mistakes and mutations within the patient’s genetic code, and hence develop targeted and personalized drugs. The project is reportedly expected to cost 300 million pounds ($470 million).

To tell you how astoundingly large $470M is, UK GDP is only $2.5 trillion (PPP) or $2.828 trillion (unadjusted) depending on how you count the beans.

-————————————————–

But what do people of Britain produce? Thanks for asking.

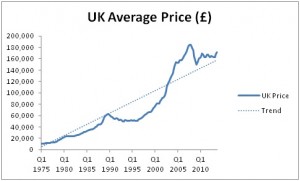

1. Housing Bubble

When house prices go up, everyone feels wealthy and spends more. The leveraged effect can sustain the economy for a long time, as explained here. When house prices go down, the opposite happens. Given that UK housing bubble started in mid-70s, it has quite a bit of leverage to get rid of. The bubble peaked in 2005-06, right around when I made similar forecast for USA, and has years and years of deflation to look forward to. Even the echo bubble is coming to an end (see below) and I won’t be surprised, if house prices eventually drop to the levels of 1990s.

The UK real estate boom has largely recovered from the brief hick-up in 2008-2009, whereby the biggest price increases were as usual seen in London and the counties in Londons immediate neighborhood. As a result, prices have not yet returned to their former peaks country-wide, but in London new record highs have been set.

Currently there is evidently a building boom underway, and builders and real estate investors just received a warning signal (it is an early warning, but a warning nevertheless). One of our readers pointed out to us that recent press reports suggest that there is currently a shortage of bricks and other building materials in the UK.

…

Why is this a warning sign? Some of our readers may recall the DRAM shortage of late 1999/early 2000, which went hand in hand with the final blow-off move in the Nasdaq Index. Such shortages of manufactured intermediate materials are usually a sign that there is excessive demand, driven by overly loose monetary policy. They can also be a sign that there has been a lack of capital maintenance in intermediate stage industries, as too low interest rates encourage both excessive investment in the highest stages of the capital structure, as well as over-consumption. Since capital is scarce, the middle stages of the production structure often suffer capital has to be withdrawn from somewhere after all.

I was working in Silicon valley as an engineer and remember that DRAM/commodities shortage very well. Here is a news article from that time (“Too Much Of A Good Thing? Red-hot demand raises fears of chip shortages”), which marked the peak of dot-com bubble well.

2. Oil

The tumbling oil price has left the UKs North Sea oil industry close to collapse experts warned today

North Sea oil and gas tycoon and government adviser Sir Ian Wood has said around 10 per cent of jobs may go, while Robin Allan, chairman of the independent explorers’ association Brindex and Premier Oil executive, said today that at current oil prices it is almost impossible to make money.

A report into the sector found 35,000 jobs could go over the next five years following the sharp fall in the price of oil. Brent crude has nearly halved since June and touched over a five-year low this week amid increased US shale oil supply and the continued output from Opec.

3. Perpetual debt (aka consols) and parasitic financial sector

That Debt From 1720? Britains Payment Is Coming

LONDON Share prices went through the roof, speculation ran wild and money poured into ill-fated ventures before the boom turned, inevitably and catastrophically, to bust.

After that financial crash in 1720, called the South Sea Bubble, the British government was forced to undertake a bailout that eventually left several million pounds of debt on its books. Almost three centuries later, Britons are still paying interest on a small part of that obligation.

Now, prompted by record low interest rates, the British government is planning to pay off some of the debts it racked up over hundreds of years, dating as far back as the South Sea Bubble.

George Osborne, the chancellor of the Exchequer, said this month that in 2015 Britain would repay part of the countrys debt from World War I, and that he wanted to pay off other bonds for debt incurred in the 18th and 19th centuries.

Thankfully, when the above three sectors fail, British GDP will be able to rely on two fast growing sectors of the economy, which were recently added to GDP calculation.

“Hookers & Blow” Lift Britain Over France As World’s 5th Largest Economy

UK gross domestic product (GDP) is expected to total $2.828 trillion (1.816 trillion) this year, compared with French GDP of $2.827 trillion, as The Centre for Economics and Business Research (CEBR) said Britain’s acceleration was boosted by the inclusion of sex and drugs to UK growth (as part of new pan-European accounting standards).

The ONS’s methodology for calculating how much prostitution is worth to the economy is based on extrapolating figures about the number of sex workers in London for the rest of the UK. However, this survey data, which is from 2004, excludes male prostitutes.

According to one estimate by Andrew Fogg, 42pc of all sex workers in the UK are male, making their omission a significant gap in the ONS’s calculations. Other economists have also labelled the attempts to estimate the size of illegal economic activity as little more than “guesswork”.

-————————————————–

What will British people get after pissing away $470M in bad science? Definitely not cure for any disease as far as I can tell. Here is what the 1000 genome project promised (emphasis mine) for spending $120 million and all they delivered was some unsubstantiated claims of GWAS hyped up in the media. Why will the outcome be different this time with a larger population?

Over the last decade, a genome-wide catalog of human genetic variation has been developed for single nucleotide variants covering most SNPS with allele frequencies > 5% in certain populations, and initial catalogs of structural variants have been developed. Based on these resources, initial genome-wide association studies (GWAS) have provided proof-of-concept that systematic, genome-wide association studies can discover new loci that contribute to common human diseases. Over 50 new loci contributing to common human diseases have been identified for diseases ranging from heart attack and diabetes, prostate and breast cancer, rheumatoid arthritis and inflammatory bowel disease, age related macular degeneration, and many others. By identifying new disease loci, each such discovery prompts much additional genetic research. For each such locus, it is currently necessary to sequence the newly discovered region to define all common and rare variants, one or a few of which contribute to disease. At present, this sequencing must be done on a case-bycase basis, and it is both expensive and inefficient.

Moreover, it is clear that discoveries yet made explain only a modest fraction of disease risk. Some of this uncaptured risk is due to alleles of lower frequency but larger effect. If such alleles are in genes already localized by GWAS, then targeted sequencing may find them; but if the genes do not carry high frequency variants of sufficiently large effect, they will go undiscovered unless deeper catalogs of variation are obtained. Similarly, some of the uncaptured risk is due to the effects of structural variants that are not in linkage disequilibrium (LD) with common SNPs; these too will go undiscovered until a detailed and complete map of structural variants is obtained to guide systematic association studies of this important class of genetic variation.

Thus, a more complete understanding of the role of genetic variation in disease requires a deeper catalog of genetic variation, both for single nucleotide and structural variants. This hadnt previously been approachable because (a) there wasnt proof-of-concept that the general approach would succeed, and thus greater investment in the resource was unjustified, and (b) sequencing costs and throughput made it impractical to sequence more deeply and broadly to create this more comprehensive catalog of genetic variants for use in genetic research.

Recently, next generation sequencing technologies have become available that appear likely to reduce the cost of sequencing by one to two orders of magnitude, and dramatically increase throughput. These technologies make it practical to produce a database of genetic variants that is deeper, broader, and more comprehensive, and that will have immediate and substantial impact in human genetics.

But even if this larger misadventure manages find to some genuinely useful loci related to diseases, that is far from finding a cure. As an example of how hard the later task is, the mutation causing Tay-Sachs disease was found in 1970s and 80s, but no cure has been found yet.

In the 1960s and early 1970s, when the biochemical basis of TaySachs disease was first becoming known, no mutations had been sequenced directly for genetic diseases. Researchers of that era did not yet know how common polymorphisms would prove to be. The “Jewish Fur Trader Hypothesis,” with its implication that a single mutation must have spread from one population into another, reflected the knowledge at the time. Subsequent research, however, has proven that a large variety of different HEXA mutations can cause the disease. Because TaySachs was one of the first genetic disorders for which widespread genetic screening was possible, it is one of the first genetic disorders in which the prevalence of compound heterozygosity has been demonstrated.[14]

Ashkenazi Jews have a high incidence of TaySachs and other lipid storage diseases. In the United States, about 1 in 27 to 1 in 30 Ashkenazi Jews are a recessive carrier. The disease incidence is about 1 in every 3,500 newborn among Ashkenazi Jews.[31] French Canadians and the Cajun community of Louisiana have an occurrence similar to the Ashkenazi Jews. Irish Americans have a 1 in 50 chance of being a carrier.[citation needed] In the general population, the incidence of carriers as heterozygotes is about 1 in 300.[3] The incidence is approximately 1 in 320,000 newborns in the general population in United States.[32]

It is sad that British government funders (spenders) cannot find clever and economic ways to solve problems, and decided to go for the most wasteful and expensive option to do nothing.