Oxford Nanopore Blows Up Lab, Raises $150M

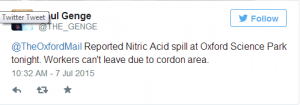

It appears that the chemists at Oxford Nanopore are as competent as their bioinformaticians. On July 8th, BBC reported that three people were injured in a “violent chemical reaction” at the company. The violent chemical reaction, as it turns out, happened due to mixing of nitric acid and alcohol, which is a complete no-no for any chemistry procedure (also see this) except by those working for ISIS. Thankfully all injured employees have been discharged from the hospital.

Readers can find additional details here -

Update: Three people injured after chemical incident closes parts of Oxford Science Park

Oxford Science Park chemical incident - three injured

-——————————–

In other news, the company raised $109M and sports a valuation of $1.55B (GBP 1B) !! Pacbio, their closest competitor, is valued at only $399M at today’s closing price.

IP Group Says Oxford Nanopore Raises GBP70 Million In Funding Round

LONDON (Alliance News) - FTSE 250-listed intellectual property company IP Group PLC on Tuesday said its Oxford Nanopore Technologies Ltd portfolio company has raised GBP70 million in a new financing round.

Oxford Nanopore is an Oxford University spin-out focused on nanopore-based electronic molecular analysis systems.

Following the completion of the financing found, which attracted existing and new investors in the UK, US and Europe, IP Group’s undiluted stake of 19.9% in Oxford Nanopore is now valued at GBP192.9 million, representing an unrealised fair value gain for IP Group on its investment of GBP50.3 million.

IP invested another GBP13.9 million in Oxford Nanopore in the latest funding round.

It is quite ironic that one of the organizations funding Oxford Nanopore is also named ISIS Innovation, but we do not see any connection with the middle eastern group of same name or ‘violent chemical reactions’.

-——————————–

What is the future of this company? Clearly, every round of extra financing acts like death spiral, because the company needs to back it up with that much revenue to support its valuation. For example, a $750M valuation would require them to sell 750K individual sequencers at $1K price (assuming revenue parity for valuation in lieu of discounted cash flow). With $1.5B valuation, that expectation goes up to 1.5M sequencers. The other possibility is to sell big machines instead of isolated sequencers, but that takes away the distinguishing factor for the company.

Another troubling aspect is that even with this much funding, the company seems to have outsourced its bioinformatics to the public funding sources (e.g. Mick Watson: “we have an active grant to develop poRe, software we are writing to help scientists access and use MinION sequence data”). Will public funding be used to support various informatics requests from 750K or 1.5M different users?

P. S. Several readers asked me about Mick Watson’s hilarious ‘4 predictions about nanopore sequencing in the next 12 months’. Human genome? Hahaha !! Wake me up, when someone assembles a previously unassembled fungal or bacterial genome using ONT sequencing only. Also, his stressing of “all of the above will be possible without seeing a single A, G, C, or T (i.e. it will all be possible without base-calling the data)” seems to suggest that he does not believe Ewan Birney’s claim about 92% accuracy of ONT sequences at the nucleotide level. Neither do we, because Birney is a proven liar exposed by Dan Graur.